The month was June, the day was Tuesday and I was spending it with Nikki as she was in England for a short while. As we were walking along the Thames, my phone rang.

“Hello Amy, it’s Annabelle, just calling to let you know that the vendor has accepted your offer”.

I stopped dead in my tracks, then shuffled to the right, because ya’know, it’s London and if you stop in the middle of a path of people there’s a huge chance that you will get squished.

“Are you joking? OMG AHH!!”

We hashed out a few details before I hung up excitedly.

“OMG, OMG, OMG THEY ACCEPTED OUR OFFER.”

After weeks of negotiations, it was official: I would soon be a homeowner. The shock was brief, as whilst the offer had been accepted, there was still a kazillion and one things that needed doing. Things that I had never done before.

You see this was the first-time I have ever bought a property. Something which I wasn’t sure I’d ever own because I’ve always been incredibly indecisive over where I want to live in the world. Combine that with the fact that the property market in England is bulls#%t and you have apprehension over whether it’s a possibility. Property in England is so often out of reach in the South because there aren’t enough affordable houses being built to accommodate the growing population. The generation before us millennials, however, had an abundance of property within their reach, and they still do. It’s amazing how much things can change in one generation, and I’m not trying to guilt trip anybody but just so there’s some perspective on what so many are up against; the generation before ours was born into a time where; rent was affordable, 100% mortgages existed and the average house price was between £5,000 – £40,000. Nowadays those very same houses which once cost under £40,000 are now priced between £250,000 – £1,000,000++ which is great for the people who bought them, but terrible for the people trying to buy them. That’s one hell of an investment. There’s no way the value of a property I bought now would quadruple in 20 years. It’s very much a seller’s market and buyers don’t have much in the way of help. Low wages, high cost of living, companies which only offer unpaid internships because they’re too cheap to pay a wage and increasing transport costs are some of the reasons. Having an addiction to avocado toast is not an actual reason, despite what an Australian Millionaire who received a $34,000 handout from his grandparents to kickstart his business wants you to think…

Sure there is the occasional Government scheme but it’s not actually as helpful for first-time buyers as the Government think. There seems to be a huge disconnect there. For example; when I was first looking for a property I went to see a couple of financial advisors to see what my options were with regards to lending and what kind of mortgage rates I was looking at. With a 10% deposit and enough cash to cover solicitor fees, I was feeling optimistic. I told the first advisor the budget I had in mind because I knew I could afford the monthly repayments, bills and still have some left over to be able to live and occasionally travel—a very important aspect of life for me. Nobody wants a mortgage that takes up all of their disposable! I didn’t want a new build and was looking for an older property. He said he understood and told me I could more than afford a property in my budget range with affordable repayments each month. Excellent! Or so I thought, because when the time came to discuss my options the advisor essentially ignored every single element of what I had previously discussed and spent the next half an hour showing complete and utter bias towards the ‘Help To Buy’ scheme.

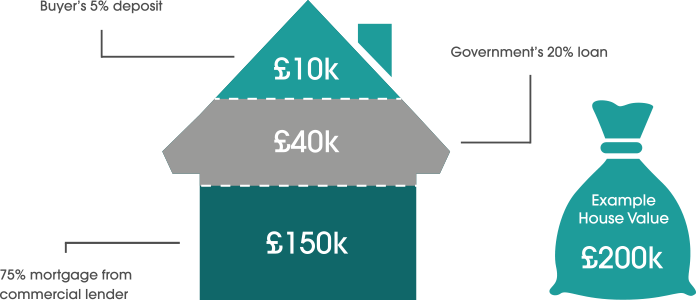

For my readers outside of the UK; the ‘Help To Buy’ scheme is a scheme implemented by our Government which was designed to help first-time buyers to get on the property ladder. It sounds amazing because so many are stuck in generation rent because we spend too much on avocado toast English property prices are bull. Anyway, the Help To Buy scheme works by the Government fronting 20% of the property’s value, enabling you (the buyer) to put down a 5% deposit instead of the usual 10%+ which is required. The remaining 75% is then covered by the mortgage lender which is paid back as a normal mortgage would be. This handy little graphic made by the Government explains the breakdown:

This scheme helps so many people to get onto the property ladder, because for the first five years, there is no interest on the 20% loan the Government provides. After the first five years, you face repayment rates of between 1-3% depending on market fluctuations. The problems come with the limitations of the scheme. For example; if you are buying as a couple you are only eligible if both parties are first-time buyers, and you cannot be linked to any other properties financially. So if your partner owns, or has owned a property previously, they’ll be considered ineligible. The scheme also prohibits you from extending, altering or subletting the property until the 20% repayment has been made. Neither of the aforementioned points are hugely problematic until you consider that this scheme is only available on new builds. The new builds that they’re not currently building enough of. The new builds that cost about £40,000 (minimum) more than an older house of the same calibre.

When I saw the pushy-for-new-builds financial advisor he basically told me that whilst I could afford our budget, if I bought a new build for £315,000 instead I could apply for the Help To Buy Scheme. So I would have essentially had to pay £65,000+ more than I wanted to, in order to afford help getting on the property ladder. Messed up isn’t it? I don’t mean to sound all “whoa is me” but WHOA IS ME. How does making people spend more than they want to, to get help, actually help people? Oh government, so helpful, so wise, so out of touch.

Prior to beginning the search for a property, I had decided that no matter what, budget would be the one thing I wouldn’t budge on. I’d change location, size and expectation; but never exceed the chosen budget. No matter how charming the building was. This rule helped to keep house-hunting in perspective because when you live in an old Roman town where not much happens; the buildings are really rather beautiful—and I am partial to character properties. If it has wonky floors and is a pain in the arse to decorate, then there is a 95% chance I’m going to fall in love with it. No disrespect to new builds, I get that they’re more economical, have better insulation and are already painted white or beige so you don’t need to do much when you initially move in. They’re just also a bit… Boring. There are no nooks and crannies, just smooth edges from floor to ceiling. It’s a bit too sterile for me.

My search for a house took a while, and it feels so weird to know that the search is over and I’m going to be getting the keys to my very own space. No more renting! I won’t lie, it’s been a mammoth amount of work, with numerous viewings and paperwork and fallen-through plans. But my advice to anyone going through the same: don’t rush. Always wait! You are buying somewhere you will see every day and you want to feel excited when you see it, not full of dread.

The property I ended up purchasing was actually down the road from one I had been renting previously. It had been on the market for a few months and I laughed because it was so ridiculously overpriced I wasn’t surprised nobody had bought it. The owner of the property I was renting from at the time, had theirs valued recently so I knew roughly what to expect price-wise—and when I saw this one was for sale around £50,000 above what they said – I knew it was a solid nope, so I didn’t even think to view it.

No exceptions on the budget remember!

But when I got back from a trip to France and noticed it was still for sale, I booked a viewing. I knew that I would like it because the row of houses were all built at the same time, in the same style, and I was living in one down the road. But I went to see it regardless because buying a property you’ve never seen would be weird.

I loved it, I put an offer in, and that was that. I didn’t think anything more of it. Not expecting them to be open to negotiations. But they were. It took weeks of going back and forth on negotiations as we tried to agree on a price. But then there I was. Walking along the Thames when my phone rang…

And after that call, I was in shock, about to make the biggest, most freaking expensive commitment I had made in my life thus far. It took two months and two days from my offer getting accepted (June 13th), to receiving the keys (August 15th) but minus a run in with the most incompetent surveyor I’ve ever had the displeasure of speaking to, the whole process ran without a hiccup.

And I can’t believe that I can officially say: I’m going to be a homeowner!